22 Oktober 2025

Memahami ROI dan Periode Pengembalian Modal Sistem Penyimpanan Energi

Karena biaya energi terus meningkat dan penetrasi energi terbarukan meningkat, Sistem Penyimpanan Energi (ESS) dengan cepat menjadi bagian tak terpisahkan dari infrastruktur energi modern.

Sebelum melakukan investasi, setiap pemilik rumah atau bisnis harus mengajukan pertanyaan yang sama: "Apakah penyimpanan energi bermanfaat secara finansial?"

Ada dua indikator utama yang menentukan jawabannya: Tingkat Pengembalian Investasi (ROI) dan Periode Pengembalian Modal.

Berapa ROI untuk Penyimpanan Energi?

ROI mengukur keuntungan ekonomi dari proyek penyimpanan energi selama siklus hidupnya relatif terhadap biaya awalnya. Biasanya dinyatakan dalam bentuk persentase dan mencerminkan profitabilitas dan efisiensi investasi secara keseluruhan.

ROI Formula

ROI (%) = (Total Pendapatan Seumur Hidup - Total Biaya Investasi) ÷ Total Biaya Investasi × 100%

Sebagai contoh, jika ESS komersial berharga $100.000 dan menghemat $20.000 dalam tagihan listrik setiap tahunnya, pengembalian kumulatif selama lima tahun akan setara dengan investasi awal - menghasilkan ROI tahunan rata-rata sekitar 20%.

Apa yang Dimaksud dengan Periode Pengembalian Modal?

Periode pengembalian modal mengacu pada waktu yang diperlukan untuk penghematan bersih kumulatif untuk memulihkan investasi awal.

Ini dapat dibagi menjadi dua jenis:

- Periode Pengembalian Modal Statis:

Total Investasi ÷ Tabungan Bersih Tahunan - Periode Pengembalian Modal yang Dinamis:

Disesuaikan dengan menggunakan discounted cash flow (DCF) untuk memperhitungkan nilai waktu dari uang-ini lebih tepat tetapi membutuhkan lebih banyak pemodelan keuangan.

Misalnya, investasi sebesar $1 juta dengan penghematan bersih tahunan sebesar $200.000 menghasilkan periode pengembalian modal statis selama lima tahun, tetapi jika tingkat diskonto 5% diterapkan, pengembalian modal dinamis diperpanjang menjadi sekitar enam hingga tujuh tahun.

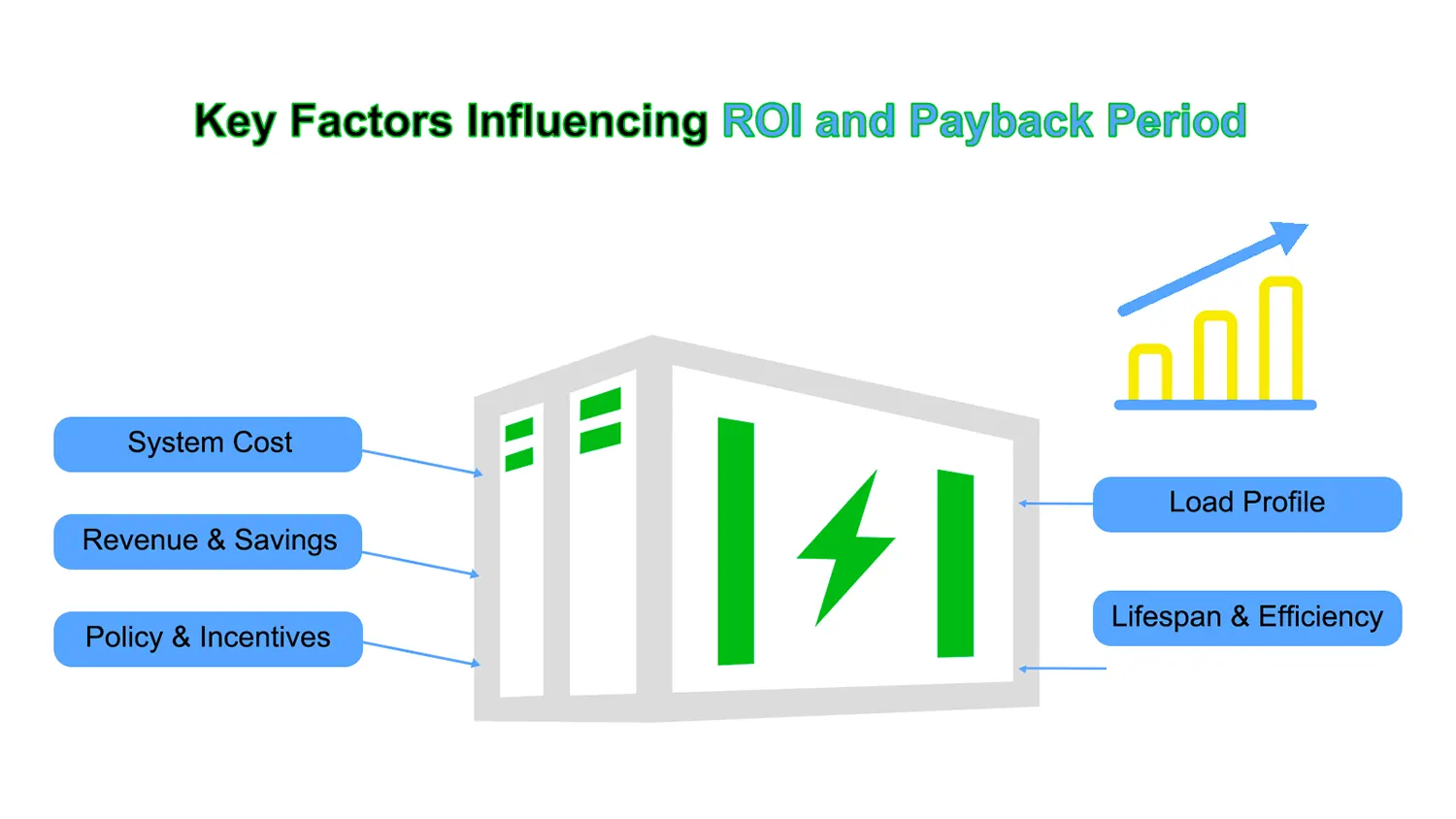

Faktor-faktor Utama yang Mempengaruhi ROI dan Periode Pengembalian Modal

Biaya Sistem

Biaya di muka tetap menjadi penentu ROI yang paling signifikan.

- Sistem residensial biasanya berharga antara $10.000 dan $15.000.

- Sistem komersial dan industri (C&I) dapat berkisar dari ratusan ribu hingga lebih dari satu juta dolar.

Kimia penyimpanan energi yang berbeda juga memengaruhi masa pakai sistem dan biaya pemeliharaan, yang pada akhirnya membentuk laba atas investasi jangka panjang.

Paket baterai dan komponen terkait (mis., PCS) menyumbang 50-65% dari total biaya sistem, dengan harga baterai rata-rata $150-250 per kWh. Oleh karena itu, sistem rumah 20 kWh akan menelan biaya total sekitar $10.000.

Aliran Pendapatan & Tabungan

Sistem penyimpanan energi menghasilkan nilai melalui beberapa saluran:

- Untuk bisnis: pencukuran puncak, pengurangan biaya permintaan, dan partisipasi dalam layanan jaringan atau pengaturan frekuensi.

- Untuk pemilik rumah: meningkatkan konsumsi mandiri PV, menghindari tarif puncak, dan menyediakan daya cadangan.

Data industri menunjukkan bahwa proyek-proyek ESS pada umumnya mencapai ROI dalam 3-5 tahun, terutama di pasar dengan tingkat waktu penggunaan (TOU) dan kebijakan insentif yang menguntungkan.

Kebijakan & Insentif

Subsidi pemerintah dan kredit pajak dapat secara signifikan memperpendek waktu pengembalian modal.

- ITC Federal A.S.: Berdasarkan Pasal 48 dari Internal Revenue Code, sistem penyimpanan energi memenuhi syarat untuk Kredit pajak 30%.

- California SGIP: Menawarkan insentif tambahan hingga $1.000 per kWh.

- Di Cina, kebijakan kompensasi kapasitas di wilayah tertentu (misalnya, Mongolia Dalam) dapat mendorong IRR proyek di atas 15%.

Mari kita ambil contoh rumah tangga di California, dengan asumsi keluarga tersebut berencana untuk berinvestasi dalam sistem penyimpanan tenaga surya 20 kWh.

Saat ini, biaya rata-rata baterai lithium sekitar USD 150-250 per kWh. Paket baterai dan komponen pendukung seperti sistem konversi daya menyumbang sekitar 50%-65% dari total investasi sistem.

Berdasarkan hal ini, total biaya sistem penyimpanan rumah 20 kWh diperkirakan sekitar USD 10.000.

Menurut Bagian 48 dari Kode Pendapatan Internal AS (26 USC Bagian 48), sistem penyimpanan energi yang memenuhi syarat memenuhi syarat untuk mendapatkan Kredit Pajak Investasi Federal 30%.

Setelah menerapkan kredit ini, investasi awal bersih untuk sistem ini berkurang menjadi sekitar USD 7.000.

Di bawah Pacific Gas and Electric (PG&E) Struktur tarif TOU:

- Tarif jam puncak sekitar USD 0,55/kWh,

- Tarif di luar jam sibuk adalah sekitar USD 0,28/kWh,

menghasilkan perbedaan tarif efektif sebesar USD 0,27/kWh antara periode puncak dan di luar puncak.

Dengan memperhitungkan efisiensi pulang-pergi dan kerugian konversi inverter, efisiensi keseluruhan sistem diperkirakan sekitar 85%.

Dengan asumsi ini, sistem dapat secara efektif melepaskan sekitar 17 kWh energi yang dapat digunakan per hari (20 × 85%), yang berarti penghematan listrik harian sekitar USD 4,6.

Penghematan tahunan ≈ $1.675/tahun

Oleh karena itu, periode pengembalian modal statis dihitung sebagai: 7.000 ÷ 1.675 ≈ 4,2 tahun.

Singkatnya, dengan harga TOU yang menguntungkan dan dukungan ITC, pemilik rumah di California dapat memulihkan investasi dalam waktu sekitar empat tahun.

Sebagai perbandingan, sistem penyimpanan energi komersial dan industri mendapatkan keuntungan dari skala ekonomi - sistem ini memiliki biaya per unit yang lebih rendah dan tingkat pemanfaatan yang lebih tinggi, sehingga menghasilkan periode pengembalian modal yang jauh lebih singkat daripada sistem perumahan.

Profil Beban dan Karakteristik Konsumsi

Jika bisnis memiliki kurva beban yang berfluktuasi dengan permintaan puncak yang terkonsentrasi dan biaya permintaan yang tinggi, penyimpanan energi memberikan pengurangan biaya yang signifikan melalui pencukuran beban puncak.

Sebaliknya, jika beban stabil dan struktur tarif sederhana, ROI akan jauh lebih rendah.

Masa Pakai & Efisiensi

Semakin lama masa pakai baterai dan semakin rendah tingkat degradasinya, semakin tinggi keuntungan jangka panjangnya.

Sistem yang beroperasi dengan andal selama 15 tahun dapat menghasilkan hampir dua kali lipat keuntungan seumur hidup dibandingkan dengan sistem yang hanya bertahan selama delapan tahun.

Di pasar di mana profitabilitas bergantung pada harga TOU dan biaya permintaan, memilih platform penyimpanan energi yang tepat sangatlah penting.

Solusi Penyimpanan Energi C&I GODE menggunakan baterai LFP yang aman yang dikombinasikan dengan sistem manajemen energi yang cerdas, yang dirancang untuk mempersingkat periode pengembalian modal sekaligus mempertahankan keandalan jangka panjang.

Jelajahi Kasus Penyimpanan Energi dengan ROI Tinggi dari GODE

Dengan arsitektur yang dapat diskalakan, dukungan operasional 24/7, dan efisiensi biaya yang telah terbukti, GODE memberdayakan bisnis untuk mencapai kemandirian energi yang sesungguhnya dan keuntungan finansial yang berkelanjutan.

Kapan Penyimpanan Energi Tidak Sepadan dengan Investasi?

Meskipun penyimpanan energi menawarkan banyak keuntungan, namun mungkin tidak layak secara finansial di semua kasus. Berikut ini adalah skenario di mana ROI cenderung buruk:

Struktur Tarif Flat tanpa Diferensial TOU

Salah satu nilai inti dari penyimpanan adalah pengisian daya secara bergiliran selama jam-jam dengan biaya rendah dan pemakaian selama jam-jam dengan biaya tinggi.

Jika harga TOU tidak ada atau spreadnya minimal, maka alasan ekonomi untuk penyimpanan akan runtuh.

Jaringan yang Sangat Andal, Pemadaman Minimal

Bagi banyak pengguna, nilai daya cadangan penyimpanan sama pentingnya dengan ROI-nya. Namun, di wilayah dengan jaringan yang sangat andal dan pemadaman listrik yang minimal, nilai asuransi ini menjadi tidak berarti.

Tanyakan pada diri Anda sendiri: "Apakah saya akan membayar beberapa ribu dolar hanya untuk menghindari pemadaman listrik selama beberapa jam setiap tahun?"

Di banyak komunitas jaringan modern, jawaban yang jujur adalah tidak.

Pola Beban Rendah atau Tersebar

Sistem penyimpanan energi bergantung pada skala dan permintaan yang terkonsentrasi.

Jika puncak energi Anda kecil atau sporadis, tingkat pemanfaatan sistem - dan dengan demikian profitabilitas - akan rendah.

Kurangnya Insentif atau Subsidi Pemerintah

Insentif pemerintah saat ini merupakan katalisator yang paling penting untuk adopsi penyimpanan.

Mereka dapat secara langsung mempersingkat waktu pengembalian modal, terutama pada tahap awal penerapan.

Dalam kasus ini, waktu pengembalian modal dapat melebihi 10 tahunyang mengakibatkan daya tarik finansial yang terbatas.

Cara Membuat Keputusan Investasi Cerdas pada Penyimpanan Energi

Penyimpanan energi bukanlah solusi yang cocok untuk semua.

Sebelum berinvestasi, evaluasi menyeluruh dan khusus harus mencakup:

- Meninjau tagihan listrik untuk mengidentifikasi spread tarif TOU

- Menilai keandalan jaringan di area Anda

- Menganalisis profil beban untuk menentukan potensi penghematan

- Meneliti semua program insentif (federal, negara bagian, dan lokal)

- Mendapatkan beberapa penawaran pemasang dan menjalankan simulasi ROI

Penyimpanan energi menjadi investasi energi yang bijaksana hanya jika data menunjukkan periode pengembalian modal yang masuk akal.

Jika tidak, mengalokasikan dana untuk peningkatan efisiensi energi atau aset alternatif dapat memberikan hasil yang lebih baik.

Kesimpulan

Seiring dengan transisi dunia menuju energi yang lebih bersih, Sistem Penyimpanan Energi muncul sebagai alat penting untuk mencapai kemandirian energi dan keuntungan yang berkelanjutan. Baik Anda pemilik rumah yang ingin memangkas biaya listrik atau pengguna C&I yang mencari ROI yang lebih tinggi, memanfaatkan insentif dan struktur tarif TOU dapat memberikan pengembalian modal hanya dalam beberapa tahun. Temukan GODE solusi penyimpanan energi cerdas hari ini dan membuka masa depan rendah karbon dengan keuntungan tinggi.

Bagikan