25 July, 2025

Top 10 battery brands in the world

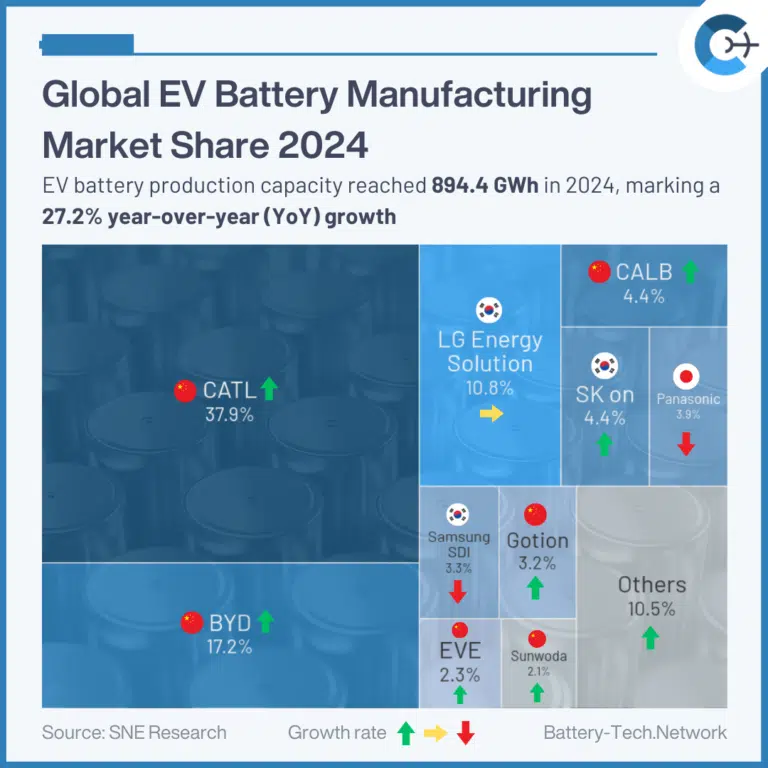

As the global energy landscape undergoes profound transformation, battery technology has become the core engine driving the development of electric mobility and renewable energy. From EV propulsion systems to solar storage and grid stabilization, batteries are critical for energy storage and release, ensuring an efficient and sustainable energy ecosystem.

This article focuses on the top ten global battery brands, providing in-depth analysis of their technological strengths, key product features, and market performance. The 2024 market overview offers up-to-date insights. Whether you are a clean energy company, system integrator, or industry observer, this ranking provides authoritative and professional reference.

1. CATL

Highlights:

- Innovative chemistry and high energy density technologies: Introduced the M3P high-magnesium lithium battery with ~15% increased energy density; the latest Condensed cell achieves up to 500Wh/kg.

- Zero-carbon manufacturing and fully integrated supply chain: The Yibin facility is the world’s first zero-carbon battery plant. Multiple production bases offer global-scale capacity. Over 90% of raw materials (such as manganese and graphite) are managed in-house.

- Extensive patent and R&D excellence: Applied for nearly 1,800 patents globally in 2023, with more than 4,400 patents granted, maintaining a solid lead in innovation.

Why It’s Popular:

- Global market leader: Holds ~37–38% of the EV + ESS market in 2023.

- OEM partnerships: Supplies major brands such as Tesla, BMW, Ford, and Volkswagen.

- Cost efficiency with safety: Focuses on LFP and sodium-ion technologies—offering low cost, long cycle life, and high safety. Achieved ~45% reduction in carbon intensity in 2023.

2. BYD

Highlights:

- Blade battery safety design: The ultrathin LFP cells pass penetration tests with no smoke or fire. Surface temperature remains around 60 °C—significantly safer than traditional formats.

- High-speed fast-charging solution: 1,000 kW ultra-fast charging system capable of 10‑C rates, adding approximately 400 km range in just 5 minutes.

- Integrated supply chain: Covers battery cells to complete vehicles, enabling rapid solution deployment and cost control.

Why It’s Popular:

- Second-largest global battery brand with ~17% market share in 2024.

- Rapid global expansion: New plants in India and Europe support overseas growth.

- Best cost-performance and safety combination: Blade battery’s high stability and low cost gives BYD competitive edge internationally.

- OEM partnerships: Supplies major brands such as Tesla, BMW, Ford, and Volkswagen.

3. LG Energy Solution

Highlights:

- Chemical foundation and precision manufacturing: Builds on LG Chem’s legacy. Employs lamination & stacking methods to reduce internal distortion and improve cell lifespan and consistency.

- Modular residential ESS solutions: Offers enblock S/S+ and Prime+ systems scalable to meet global home energy storage needs.

- Strategic ESS expansion: The Arizona plant aims for 16 GWh output by 2026, targeting 30 GWh capacity and full domestic manufacturing under the US IRA policy.

Why It’s Popular:

- Preferred supplier to Western OEMs: Provides reliable cells for Ford, General Motors, Volkswagen, and others.

- Transitioning toward energy storage: As US EV demand slows, LGES pivots to storage battery production to grow earnings.

- High safety standards: Uses reinforced separators and industry‑compliant safety certifications (UL 9540A / NFPA 855), with multilayer thermal propagation interruption.

4. CALB

Highlights:

- Rapid scale-up with LFP dominance: Shipped ~39.4 GWh in 2024 (a 17% increase year-on-year). Specializes in LFP chemistry with long cycle life and high safety.

- Flexible support for new EV makers and ESS: Primary supplier to Nio, Li Auto, XPeng, and expanding into energy storage markets.

Why It’s Popular:

- Strong growth trajectory: Quickly rose into the global top five, with full supply chain and rapid capacity expansion.

- Stable backing: Benefits from government support and industry funds, offering solid capital and distribution leverage.

5. SK On

Highlights:

- Dual chemistry support (NCM and LFP): Offers both high-energy-density and safety-focused battery lines suitable for international EVs.

- Expanding ESS manufacturing: Benefits from growing energy storage trends and shifting some production toward ESS applications.

Why It’s Popular:

- Trusted OEM partnerships: Supplies batteries to General Motors, Hyundai, etc.

- ESS orientation boosts competitiveness: Moving beyond traditional OEM roles toward energy storage enhances profit potential.

6. Panasonic

Highlights:

- Expertise in cylindrical cells: Trusted Tesla partner, leading in 2170 and 4680 cell technologies.

- Reliable production capability: Continuously supplies high-end automakers like Tesla with quality cells.

Why It’s Popular:

- Long-term reliability: Established technology and consistent quality build strong customer trust.

- Sustained market presence: Despite slight declines, shipped ~35.1 GWh in 2024, maintaining 3.9% market share.

7. Samsung SDI

Highlights:

- Broad application coverage: Serves passenger EVs, storage systems, and consumer electronics.

- Ongoing technology upgrades: Improving separator materials and safety systems.

Why It’s Popular:

- Cross-industry reach: Partners with Daimler, BMW, and Rivian across diverse applications.

- Technical leadership despite volume dip: Shipped ~29.6 GWh in 2024, with a modest ~10% decline from previous year.

8. Gotion High-Tech

Highlights:

- Powering both EV and ESS sectors: Reached ~28.5 GWh in 2024 (up 73%). Produces LFP batteries extensively used in domestic OEMs and energy storage projects.

Why It’s Popular:

- Notable capacity growth: Leveraging its Anhui factories to support fast expansion and wide partnerships.

- Efficient supply chain and cost control: Strong synergy across battery-to-system integration.

9. EVE Energy

Highlights:

- Multiple chemistry expertise: Offers both NMC and LFP batteries. Excelled in ESS applications with ~20.3 GWh shipped in 2024 (+26.9%).

Why It’s Popular:

- Rapid ESS business growth: Increasing market share as a dedicated storage battery supplier.

- Broad application coverage: Serves consumer electronics, EVs, and storage markets with flexible solutions.

10. Sunwoda

Highlights:

- Diversified origin from consumer electronics: Grew rapidly into the battery space, with ~18.8 GWh shipped in 2024 (+74%). Offers cell to system solutions across battery types.

Why It’s Popular:

- Cross-sector production strength: Factories in China, India, Vietnam, and Hungary support global supply.

- Versatile and cost-effective: High value in diverse applications and competitive pricing.

Above is a comprehensive analysis of the world’s top ten battery brands. These manufacturers—driven by cutting-edge technology, outstanding product reliability, and continuous innovation—are steering the future of electric vehicles and renewable energy storage. From high-energy-density propulsion batteries to robust grid-scale storage, they play indispensable roles in global energy transformation.

Whether you are an EV OEM, a storage system integrator, or a future-oriented user, choosing the right battery brand is a crucial step in achieving sustainable growth and maximizing system value.

share